Alphabet (GOOG) stock slipped yesterday on rumors that Apple is preparing for a radical move that would strike at the heart of Alphabet’s ad empire.

The latest blow came from a Bloomberg report suggesting Apple is exploring a partnership — or even an investment — in Perplexity, a buzzy AI-powered search startup that’s gaining traction as an alternative to Google.

The news builds on earlier reporting from Investors Observer pointing to Apple’s quiet push into AI search.

The speculation gained new momentum thanks to testimony from Apple’s senior vice president of services, Eddy Cue, during Google’s ongoing antitrust trial.

“We’ve been pretty impressed with what Perplexity has done, so we’ve started some discussions with them about what they’re doing,” Cue said under oath.

Analysts took that remark as more than casual curiosity. Stocktwits host Shay Boloor interpreted Cue’s comments as a potential bombshell, calling it “a signal that Apple is eyeing to replace Google Search on iPhone.”

$GOOGL DOWN PRE-MARKET AS $AAPL REPORTEDLY EYES PERPLEXITY TO REPLACE GOOGLE SEARCH ON IPHONE pic.twitter.com/XFb4B71jH2

undefined Shay Boloor (@StockSavvyShay) June 3, 2025

If that happens, Google’s grip on the world’s most valuable real estate — the iPhone’s default search bar — could finally loosen.

It would also put Google at risk of losing a chunk of the estimated $20 billion it pays Apple annually to remain the default search engine.

The timing couldn’t be worse for Alphabet. Bloomberg also reported that Samsung is accelerating its own partnership with Perplexity, which could begin rolling out on Galaxy S26 phones later this year.

Combined, Apple and Samsung shipped over 448 million smartphones in 2024.

Losing search placement on even a fraction of those devices would be a significant blow to Google’s traffic pipeline and its advertising moat.

The Chrome threat

As if that weren’t enough, Barclays warned this week that the Department of Justice’s ongoing antitrust case could pose an even more direct threat to Google’s ecosystem.

“The probability of a Chrome divestiture, while low, has increased in our view,” analyst Ross Sandler wrote in a note to clients. He called the possibility “a major development — a black swan event for GOOGL shares.”

“Shares would obviously trade off significantly if this were to play out,” Sandler added, noting that “no investors we speak to are thinking this remedy plays out.”

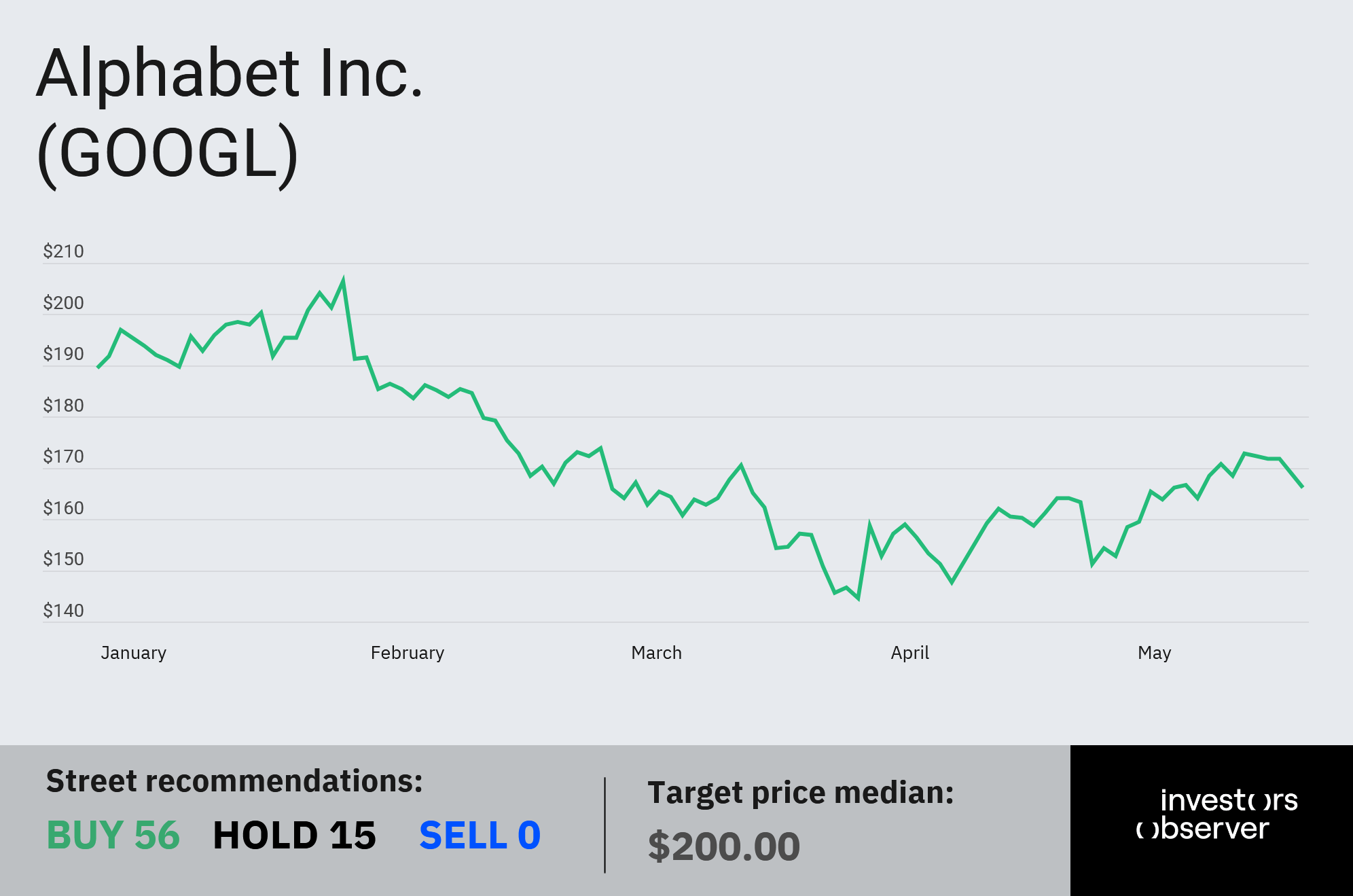

Alphabet shares were down 1.56% yesterday and 11.6% from recent highs, but remain up modestly year-to-date. Alphabet’s market cap sits just above $2 trillion, making it the fifth-largest U.S. company by valuation.

Your email address will not be published. Required fields are markedmarked